Bet on Gold: Is Gold a Bubble?

16 July 2013. A bit atypical article on our website, however it deserves to be here. Until recently the price of gold has been growing substantially over the last ten years. It attracted the attention of mass media and thus, as well, of ordinary people who would not care for gold at all. They often let themselves enticed by sensational forecasts of how high the price of gold can rise and they simply bet on gold too. However the price of gold has gone down recently. Is gold a bubble and is buying of gold today a gamble?

Gold is a precious metal that has been maintaining an extraordinary position for centuries. Until recently gold was considered to be a safe haven for investors, companies, traders, banks, governments and individuals as well. No wonder, in the environment of loose monetary policy that has been employed by almost all central banks in the world – U.S. Federal Reserve System (FED), European Central Bank (ECB) or Bank of Japan (BoJ) – the concerns about diminishing value of fiat currencies are justified.

Commodity Money, Fiat Money, Money Creation

What is money, commodity money, fiat money, currency? Briefly said: Money is the medium of exchange. Money is the most exchangeable form of assets. (Almost) everybody wants it and/or is willing to accept it. By means of money any goods or services can be exchanged one for another.

Money makes life and economic transactions much easier. In economics we talk about so called indirect exchange: I sell flour, get money and buy shoes for that. If there was no money, I would have to find a shoe maker who wants (and requires) a specific amount of flour was the shoes. One of the good properties of money is its divisibility.

Money can be anything that people are willing to accept for their products and services. Money is a generally accepted equivalent. Money needs not to be in the form of bank notes and coins as we know it today. Once it was possible to pay with precious metals such as gold and silver, in some cultures they used shells etc. Simply money is anything that people accept as they believe that the others will be willing to accept it too. This belief is highly important, especially today at times of fiat money.

What is commodity and fiat money? It is best explained by examples. In a history if someone got or saved e.g. an ounce of gold, he could bring it to a bank and the bank issued a bank note, whose value corresponded to the price of gold. If the bank was not allowed to dispose of the gold (to lend it) and had to keep it as a reserve, then the bank now is 100% commodity money (the value of money is based on the valuable commodity).

Money does not need to be “covered” by gold and other precious metals only. The same situation would occur if you brought your savings to the bank and the bank could not dispose of them. The bank would be allowed to lend their own money only (which had had to be saved before in some manner). The quantity of money in circulation would not change (raised).

However the current state of affairs is different. The bank is required by legal regulations to maintain only a fracture of the deposits known as minimum reserve requirements. It may differ by countries, but it is as low as 2% only. It is obvious that the banks usually do not hold more reserves than required as they can lend the money and gain interest on it.

Apart from legislation this process is allowed by recognition that it is highly unlikely that all depositors require all deposits at the same time. This is a nightmare of bankers known as run. Run could bring down any bank. However it should not happen to a strong bank without apparent problems under normal conditions.

Let us have a look at what happens if you bring e.g. $100 to a bank. The bank holds $2 (2%) as a reserve and $98 lends to a borrower. The borrower, or the one who is paid by him, brings $98 to his bank that again holds 2%, now out of $98, which is $1.96, and the bank lands remaining $96.04 to another borrower. This process aka multiplication of bank deposits goes on. The multiplier is the reciprocal value of the minimal reserve requirement (r), thus 1 ÷ r. In our case (2% = 0.02) 1 ÷ 0,02 = 50. The volume of money in circulation multiplies 50-fold to $5,000 by the initial $100 deposited in the bank.

Another way to increase the quantity of money is money printing, which is the power of central banks. “Money printing” is a mere history-based name as today it is done via digital entries in the balances of the commercial banks. At present we can witness large manipulations with quantity of money and interest rates by central banks that are supposed to independent, especially on the government activities. However most steps as it seems are coordinated.

It is a frequent case that government borrows money from companies or people, i.e. issues government bonds, but they paid back by newly issued fiat money (there is no amount of e.g. precious metal corresponding to it). The payback of debt is known as debt monetization. It causes inflationary and currency depreciation pressures. You yourself would probably welcome this possibility of paying back your debts (to simply “draw” a $100 bill and pass it to your neighbor).

This money created out of thin air is called fiat money. The word fiat comes from Latin and is connected with the biblical phrase Fiat lux – Let there be light. Fiat money or let-there-be money is simply born into this world based on no real value.

Rise of Gold: Concerns about Money Printing and Depreciation

He, who does not profit on the newly emitted money, can be justifiably concerned about depreciation of his own savings. And that is the time for gold to come to light. First, the quantity of gold is not unlimited; second, gold mining is not as easy as digital money printing.

Today’s currencies are fiat money, whose circulation and acceptance is enforced by state. The currencies are “covered” only by the belief of people that other people will accept them as well. In the last 10 to 15 years, especially after the crisis in 2008, there have been massive monetary manipulations aiming at “stimulation” of the economy.

The opposite is likely to be true as the problems will only be postponed, time to solve them wasted, and the consequences will be worse. There is a principle of scarcity in the economics. A lack of something is perceived to be more valuable, redundancy decreases value in the eyes of people. It is the same with fiat money, whose quantity grows constantly.

Gold Price. Is Gold a Bubble?

The development of gold prices in the last decade shows a growing mistrust in fiat money. The growth of gold price can be interpreted in another way: it is not the price of gold rising, it is the value of dollar diminishing. By buying of gold people create their own monetary reserves. Moreover gold has another utility value apart from monetary purposes (in jewelry, technics, etc.).

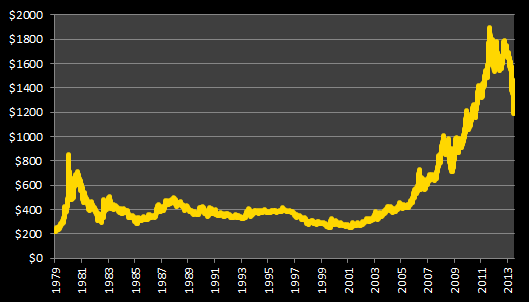

The following chart shows daily gold prices in U.S. dollars from 1 January 1979 to 12 July 2013.

Figure 1: Daily gold dollar prices 1 January 1979 to 12 July 2013, data source: gold.org, own graphics

We may notice quite a steep growth of gold price in the last ten years. However gold as a safe haven has recently suffered a flaw in the form of its price decline caused by sell outs.

Have You Bought Gold?

Have you bought gold at the top of its price or let us say in the range of $1,700 to $1,895? Me and my colleagues often discussed the price of gold. It is easy to “be the king” afterwards, however I have always claimed that:

(1) buying gold at this time (at around $1,800 an ounce) seems to be risky in the short run, that the price of gold might be a well-inflated bubble—judged by the attention of media and laymen, which often indicates that the price has reached the top;

(2) with the same breath I have added that, in the long period such as 10 or 20 years, those who bought gold today will prove to be right. Don’t sell gold, hold on. The loss is realized by closure of the deal. So far it is just virtual. If a man is not forced to sell, then, in my opinion, he won’t lose in the long run.

Gold peaked on 5th and 6th September 2011 with the closing price of $1,895.00 per Troy ounce (oz). Today’s price of gold (16th July 2013) oscillated around $1,285 per oz. It means that since its peak in September 2011 the price of gold fell by 32%. And on the beginning of New Year (as of 2nd January 2013) the price was $1,694/oz. Thus the price of gold fell by 24% since the New Year.

It may be a buying opportunity, although the pessimists say that the price can further go down to as low as $1,000 per Troy ounce, before it goes up again. It is a part of a healthy growth (or trend or bull market) that the corrections occur at times.

A question for you: if you had a grandpa and could ask him years ago to hide in the ground $100 bill or an equivalent of physical gold, what would you choose? A great number of world currencies were devalued, depreciated, went through monetary reforms or even ceased to exist. If you chose $100 bill, you would likely find a highly depreciated piece of paper (it might have had a collector’s value though). One hundred dollars at that time must have been a good deal of money and today you would not be able to buy as much as that time for $100. But if chose gold…

Place of Gold, Pros and Cons, Possible Future Development

What’s the “fair” price of gold? First of all it needs to be said that the price of gold is maintained by supply and demand. The “value” of gold—as for other commodities, goods or services—is assigned by consumers, of whom each of them perceives the value subjectively.

Gold, on the contrary to saving products and equities, is at a disadvantage as it bears no interest or dividend. To receive them can be a small “pain killer” in case the market price of your equities went down for whatever reason. Moreover gold might bring additional costs e.g. related to its security, but one has to concern also opportunity costs (for the same money you could buy shares that bring some dividend yields). Warren Buffett, one of the most successful and richest investors in the world, for these reasons claimed that he wouldn’t buy gold even at $800 per oz.

Gold is a commodity that is speculative by its nature as you expect that there will be someone else willing to buy it at higher price one day in the future. On the other hand—in fiat money printing environment—nobody knows what the “correct” price of gold is. Newly issued fiat money is poured into the real economy and inflate asset prices such as equities, precious metals, oil and other commodities etc.

As long as central banks do experiments with money printing, it is grounded to expect that the price of gold will rise along with that to $2,000, $5,000 or $10,000, why not. That’s why it is good to own some gold as a protection from fiat money or monetary system meltdown (about 10% of assets is generally recommended).

There is quite a rational reason for investing in gold today, even though its price can still fall from a short point of view. At today’s price around $1,280 per Troy ounce it is for many mining companies almost unprofitable to dig gold as the production costs per one Troy ounce of gold is about $1200; in case of some Australian miners it is $1000 per oz (source: CNBC.com). Such low price of gold is unsustainable in the long run and might endanger the existence of some of the miners. That would result in a decline of gold quantity or its shortages and thus in the likely growth of price.

A similar situation occurred in case of oil after the world financial crisis in 2008. The price of oil fell to the level of about $40 per barrel, while the production cost were estimated to be about $80 per barrel. It was unsustainable as well. Now the price of oil is about $105 per barrel.

Remember that gold cannot be “printed” as easily as paper (electronic) money. Quitting of money printing by central banks does not seem to be realistic. Recently FED chairman Ben Bernanke has only mentioned that they could start capping of monetary stimuluses’ (which would be bad news for gold), however it was followed by a swift decline of equity markets and it gave us a flavor of what could happen if monetary stimulus would be stopped.

We can assume that it will not be the case in a near future as it would likely cause an implosion of highly indebted U.S. economy, plus it is a common knowledge that inflation or currency depreciation favors the debtors on account of the creditors. And so money printing is likely to continue, waiting for a miracle to come and fix the economy. At most the problems will be postponed, not fixed, but the politicians must be elected or reelected today.

However refusing to take pain now will cause bigger problems in the future. The longer it takes, the worse the impacts will be. All this experiment of massive monetary manipulations with quantity of money and interest rates (they are kept artificially low) is likely to end up by great depreciation, not to say a death of dollar as we know it today.

At present nobody, including China, which is the biggest creditor of USA, is interested in dollar and thus one’s own assets depreciation. One day time may come that the creditors, investors or traders will say enough is enough. We will see, only time can prove or disprove these views and opinions.

You Might Be Also Interested

- Artificial Intelligence Insights and Key Factors on Gold Price (2024-01-18);

- Price of Gold Broke the Historic Record from August 2020 (2023-12-04);

- Gold: What It Is, How to Invest in Gold Mining Companies;

- How to Determine Expected Return and Risk in Investment;

- Expected Return and Risk in Entrepreneurship.

Taken from the original Czech article: Sázka na zlato (Bet on Gold).